| << Chapter < Page | Chapter >> Page > |

The owner of the plant soon demanded an increase in protective tariffs from 5%-20%. If granted, this subsidy would have resulted in large rents for the owners. In fact, the subsidy itself would have amounted to 171% of the firm’s total investment . Who would pay the costs of the subsidy? Indonesian consumers . The rate of return to the shareholders would be about 40% per year, given higher protection.

Are these rents worth competing for?

Yes.

Consider estimates reported by Anne Kruger for Turkey and India, in both countries, rents to imports from import licenses alone were very sizable – annually : 7.5% of GNP in India, 15% in Turkey and in the U.S., Richard Posner's estimates cost of rent-seeking in 1970 = 3% of GNP.

Ann Kruger argues that rent-seeking is not unlike any other kind of economic activity, such as production or distribution of goods. She plausibly argues that rent-seeking firms use up resources in rent-seeking activities just as they do in producing goods. Hiring of “expediters” (brokers), lobbying, and in some cases bribery .

A whole literature has developed to extend Kruger’s original work.

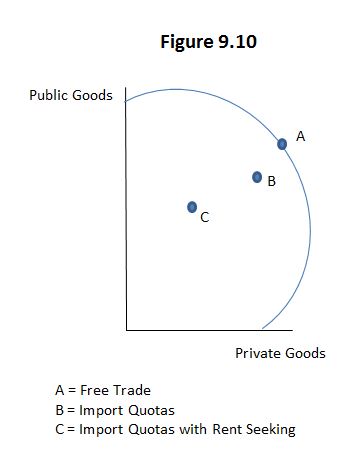

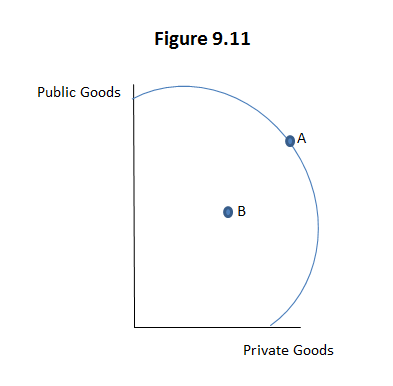

In her first contribution on the topic, she proceeded as follows. She used import restrictions as an example . She used a simple model to show how free trade can put a society on its P.P. curve, not within it.

She then showed how an import restriction reduces society’s welfare even without rent-seeking (leads to ordinary allocative efficiency losses) (Point B).

Then she shows (conceptually) how competitive rent-seeking coupled, with import restriction reduces a society’s welfare by even more than in the case of the import restriction without rent-seeking.

In sum, she shows how rent-seeking activities result not just in transfer of economic welfare from one group to another, and also destruction of economic welfare, since it also affects resource allocation and causes needless waste.

And rent-seeking activities have serious implications for income distribution as well.

Who benefits most from rent-seeking? The weak and the poor, or the rich and the influential? Who do you think?

Rent-seeking theorist’s hypothesize that perhaps in many countries the distribution of income that we observe may be more the unintended and untenable product of successful rent-seeking activities than of skewed ownership of factors of production. (Certainly true of Bolivia, Venezuela, Argentina, Kenya and Brazil).

Those groups who, because of political familial or other connections, manage to get access to scarce franchises, or to subsidized credit, or manage to have quotas imposed on imports of a product they produce, can end up with huge income that bear little relationship to whether they can produce efficiently.

Thus, the rent-seeking literature maintains that access to public government favors may be almost as important in determining income as access to property and skills.

U.S. analogue, Washington D.C. had the highest per capita income in the U.S. in 2012. Why? Many consulting and lobbying firms in Washington are headed by former congressmen and former civil servants. What are they selling?

Notification Switch

Would you like to follow the 'Economic development for the 21st century' conversation and receive update notifications?