| << Chapter < Page | Chapter >> Page > |

In the global economy, trillions of dollars of financial investment cross national borders every year. In the early 2000s, financial investors from foreign countries were investing several hundred billion dollars per year more in the U.S. economy than U.S. financial investors were investing abroad. The following Work It Out deals with one of the macroeconomic concerns for the U.S. economy in recent years.

Imagine that the U.S. economy became viewed as a less desirable place for foreign investors to put their money because of fears about the growth of the U.S. public debt. Using the four-step process for analyzing how changes in supply and demand affect equilibrium outcomes, how would increased U.S. public debt affect the equilibrium price and quantity for capital in U.S. financial markets?

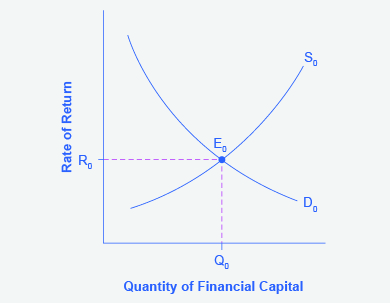

Step 1. Draw a diagram showing demand and supply for financial capital that represents the original scenario in which foreign investors are pouring money into the U.S. economy. [link] shows a demand curve, D, and a supply curve, S, where the supply of capital includes the funds arriving from foreign investors. The original equilibrium E 0 occurs at interest rate R 0 and quantity of financial investment Q 0 .

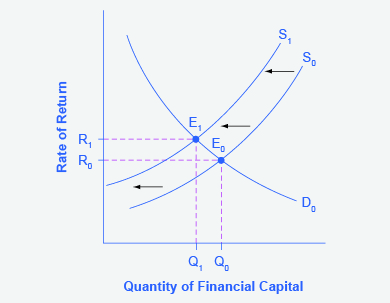

Step 2. Will the diminished confidence in the U.S. economy as a place to invest affect demand or supply of financial capital? Yes, it will affect supply. Many foreign investors look to the U.S. financial markets to store their money in safe financial vehicles with low risk and stable returns. As the U.S. debt increases, debt servicing will increase—that is, more current income will be used to pay the interest rate on past debt. Increasing U.S. debt also means that businesses may have to pay higher interest rates to borrow money, because business is now competing with the government for financial resources.

Step 3. Will supply increase or decrease? When the enthusiasm of foreign investors’ for investing their money in the U.S. economy diminishes, the supply of financial capital shifts to the left. [link] shows the supply curve shift from S 0 to S 1 .

Step 4. Thus, foreign investors’ diminished enthusiasm leads to a new equilibrium, E 1 , which occurs at the higher interest rate, R 1 , and the lower quantity of financial investment, Q 1 .

Notification Switch

Would you like to follow the 'Principles of economics' conversation and receive update notifications?