| << Chapter < Page | Chapter >> Page > |

By the end of this section, you will be able to:

There are two main categories of taxes: those collected by the federal government and those collected by state and local governments. What percentage is collected and what that revenue is used for varies greatly. The following sections will briefly explain the taxation system in the United States.

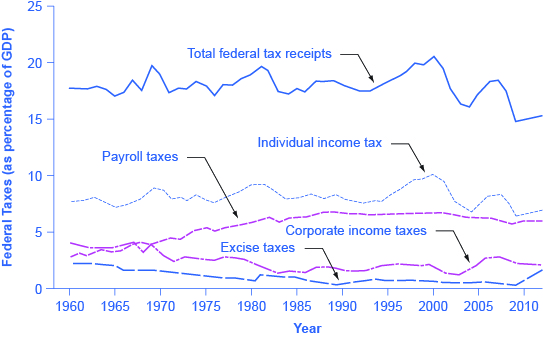

Just as many Americans erroneously think that federal spending has grown considerably, many also believe that taxes have increased substantially. The top line of [link] shows total federal taxes as a share of GDP since 1960. Although the line rises and falls, it typically remains within the range of 17% to 20% of GDP, except for 2009, when taxes fell substantially below this level, due to recession.

[link] also shows the patterns of taxation for the main categories of taxes levied by the federal government: individual income taxes, corporate income taxes, and social insurance and retirement receipts. When most people think of taxes levied by the federal government, the first tax that comes to mind is the individual income tax that is due every year on April 15 (or the first business day after). The personal income tax is the largest single source of federal government revenue, but it still represents less than half of federal tax revenue.

The second largest source of federal revenue is the payroll tax (captured in social insurance and retirement receipts), which provides funds for Social Security and Medicare. Payroll taxes have increased steadily over time. Together, the personal income tax and the payroll tax accounted for about 80% of federal tax revenues in 2014. Although personal income tax revenues account for more total revenue than the payroll tax, nearly three-quarters of households pay more in payroll taxes than in income taxes.

The income tax is a progressive tax , which means that the tax rates increase as a household’s income increases. Taxes also vary with marital status, family size, and other factors. The marginal tax rates (the tax that must be paid on all yearly income) for a single taxpayer range from 10% to 35%, depending on income, as the following Clear It Up feature explains.

Suppose that a single taxpayer’s income is $35,000 per year. Also suppose that income from $0 to $9,075 is taxed at 10%, income from $9,075 to $36,900 is taxed at 15%, and, finally, income from $36,900 and beyond is taxed at 25%. Since this person earns $35,000, their marginal tax rate is 15%.

Notification Switch

Would you like to follow the 'Principles of macroeconomics for ap® courses' conversation and receive update notifications?