| << Chapter < Page | Chapter >> Page > |

The earned income tax credit (EITC) , first passed in 1975, is a method of assisting the working poor through the tax system. The EITC is one of the largest assistance program for low-income groups, and projections for 2013 expected 26 million households to take advantage of it at an estimated cost of $50 billion. In 2013, for example, a single parent with two children would have received a tax credit of $5,372 up to an income level of $17,530. The amount of the tax break increases with the amount of income earned, up to a point. The earned income tax credit has often been popular with both economists and the general public because of the way it effectively increases the payment received for work.

What about the danger of the poverty trap that every additional $1 earned will reduce government support payments by close to $1? To minimize this problem, the earned income tax credit is phased out slowly. According to the Tax Policy Center, for a single-parent family with two children in 2013, the credit is not reduced at all (but neither is it increased) as earnings rise from $13,430 to $17,530. Then, for every $1 earned above $17,530, the amount received from the credit is reduced by 21.06 cents, until the credit phases out completely at an income level of $46,227.

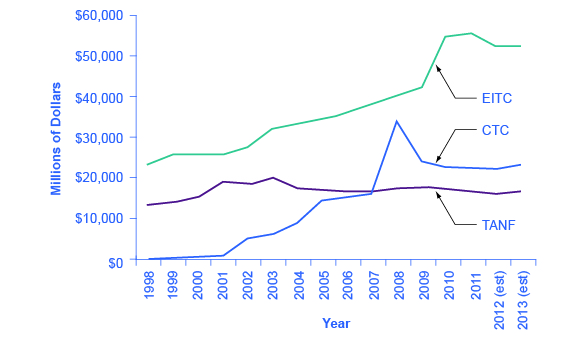

[link] illustrates that the earned income tax credits, child tax credits, and the TANF program all cost the federal government money—either in direct outlays or in loss of tax revenues. CTC stands for the government tax cuts for the child tax credit.

In recent years, the EITC has become a hugely expensive government program for providing income assistance to the poor and near-poor, costing about $60 billion in 2012. In that year, the EITC provided benefits to about 27 million families and individuals and, on average, is worth about $2,296 per family (with children), according to the Tax Policy Center. One reason that the TANF law worked as well as it did is that the EITC was greatly expanded in the late 1980s and again in the early 1990s, which increased the returns to work for low-income Americans.

Often called “food stamps,” Supplemental Nutrition Assistance Program (SNAP) is a federally funded program, started in 1964, in which each month poor people receive a card like a debit card that they can use to buy food. The amount of food aid for which a household is eligible varies by income, number of children, and other factors but, in general, households are expected to spend about 30% of their own net income on food, and if 30% of their net income is not enough to purchase a nutritionally adequate diet, then those households are eligible for SNAP.

Notification Switch

Would you like to follow the 'Principles of economics' conversation and receive update notifications?