| << Chapter < Page | Chapter >> Page > |

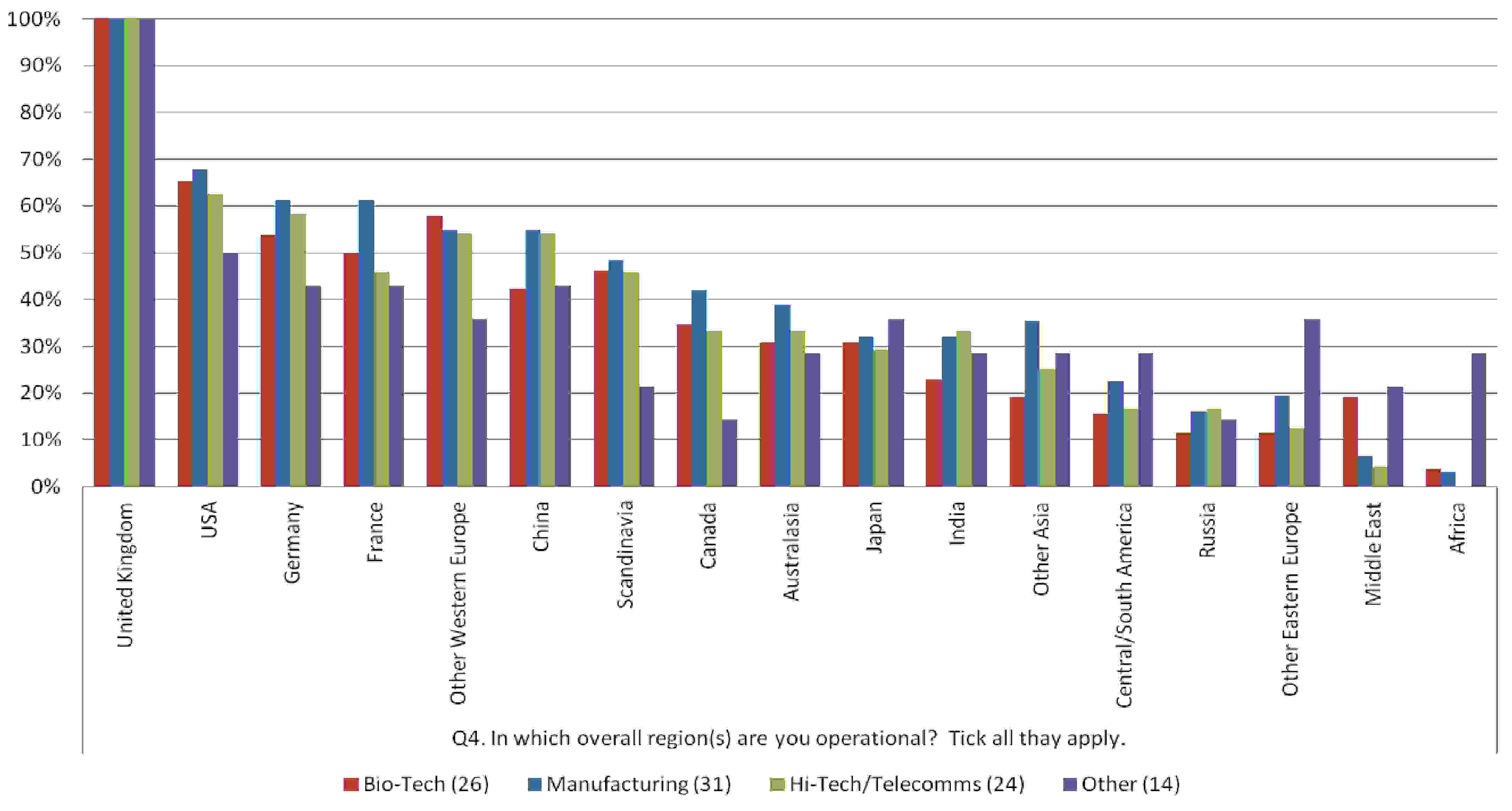

Access to markets is an important factor to any companies no mater its size or annual revenue. Davies&Weinstein 1999 argued the evidence of the importance of increasing returns, in combination with comparative advantage resulting in the importance of market access in economic geography of course included in these comparative advantages are also regulatory factors as is the case for the US and Europe in the form of the Food and Drug Administration (FDA) and the European Medicines Association (EMA). To consider access to markets of the KTN respondent’s areas of operation by sector and size (both employment and turnover) were considered. 100% of all respondents indicated that they operate within the United Kingdom as can be seen in [link] with an interesting saturation of by sectors of the US, Germany, France, Other Western Europe and China with above 50% of most sectors in operation in those regions. Within the respondents of the KTN is the Manufacturing sector that has a higher proportionality of operation within Canada, Australasia, India, Other Asia, Central/South America and Other Eastern Europe. Manufacturing traditionally is more mature in their growth phase and are more financial stability, and has slower growth, with high emphasis on spending and cost control, and less emphasis on R&D and growth strategies (Rudd 2008). These “Cost Control” may well be the reasons of choosing these locations as they historically have a low labour cost. Whereas the Bio-Tech sector, populated with more small companies ( [link] ) has a higher proportionality of areas of operation that have a larger market share and comparative advantage/influence as Davies&Weinstein 1999 and Hanson 2005 argue, and a more traditional decline in areas that are have less of a market advantage/influence.

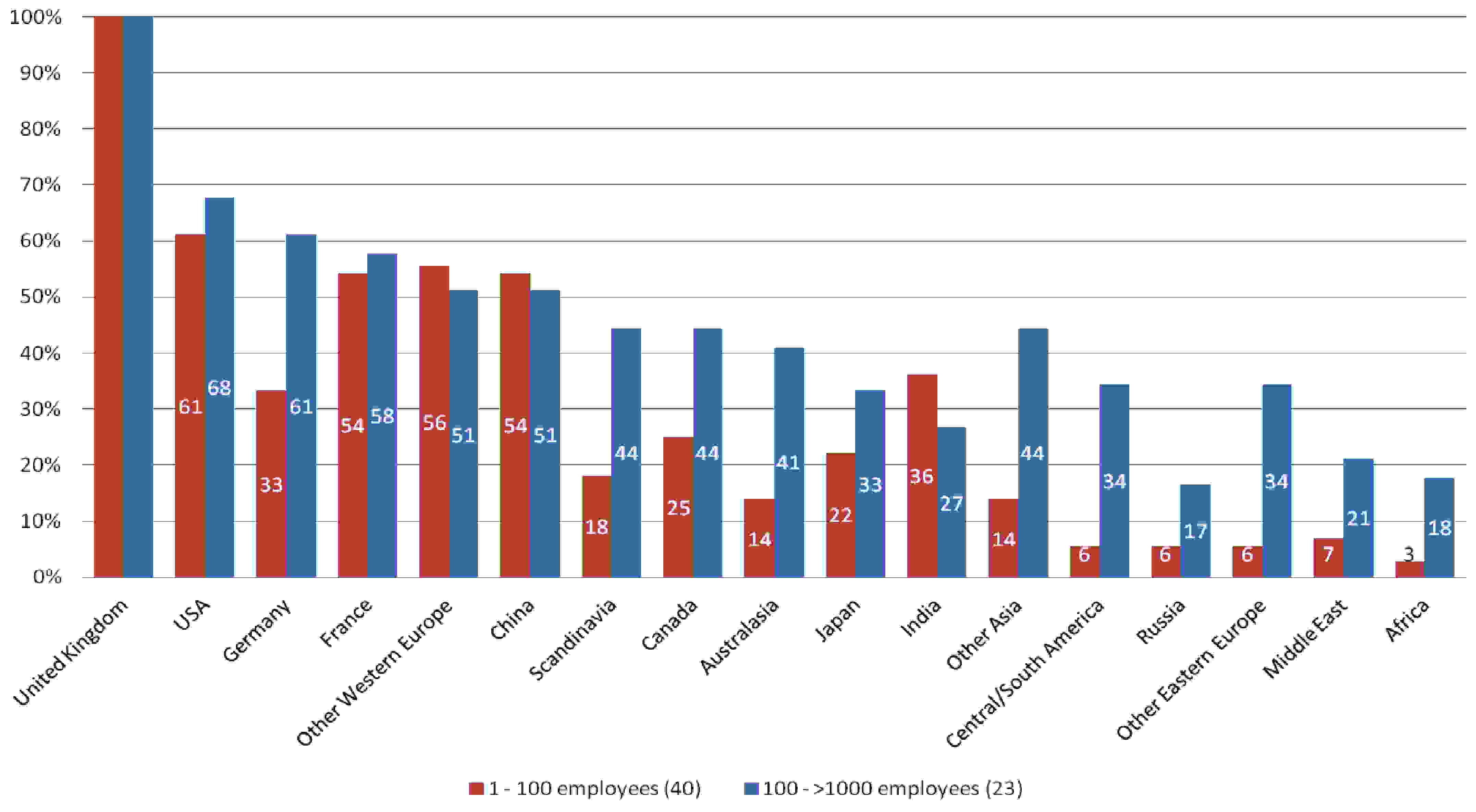

For the purpose of this study location of operation cannot solely be dictated by sector alone and the dichotomy of company size and annual revenue plays a key factor on a companies abilities. As could be expected and seen in [link] and [link] , small companies find it hard to cover more space less geographical cover than large companies. Yet small companies have a higher population in the areas that could possibly give them low cost advantages.

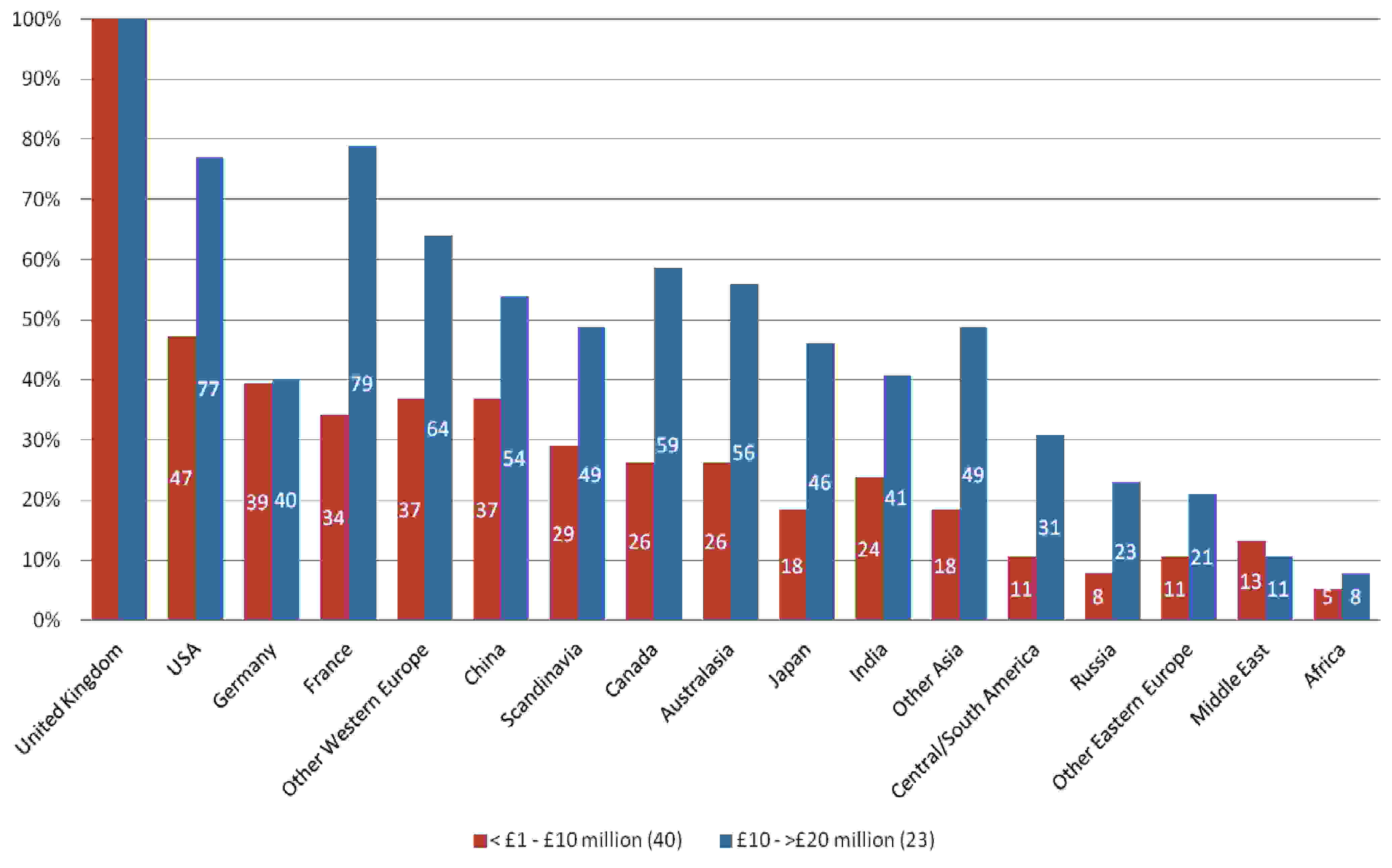

Interestingly though looking at areas of operation by annual revenue the companies less than £10m annual revenue are more evenly spread globally. This may be due to several factors that could leverage low cost advantage to them i.e., knowledge hubs and expertise in those locations. University expertise and knowledge, especially in the field of Nanotechnology, is important to the growth of companies and ability to innovate.

As can be seen in [link] and [link] that there a good proportion of both small and large companies spread through the more developed region that have a stronger ability to manage and regulate as would be expected large companies with higher annual revenue have a high percentage of global spread where those with annual revenue less than £10m have a smaller distribution globally. Yip et al. 2006 argues, “Managers of the large British companies need to be competitive internationally” (Yip et al. 2006). Yip et al. 2006 and Osegowitsch 2008 argues that revenues is a metric indicating the ability of a company to work globally, where as they are a better and more stable indicator over time because small enterprises can have very large market capitalisations (Yip et al. 2006, Osegowitsch 2008). Malbert et al. (2003) notes that companies of different sizes tended to do different things in their implementations of their resource planning and that there were differences in the outcomes and benefits attained by the enterprises. This follows suit to the regional importance to the respondents in the KTN questionnaire. In the case of China interestingly the literature argues that the Chinese Nationals educated abroad in technology fields are moving back to China as it is becoming a more Technology Economy (Bradsher 2010).

Notification Switch

Would you like to follow the 'A study of how a region can lever participation in a global network to accelerate the development of a sustainable technology cluster' conversation and receive update notifications?