| << Chapter < Page | Chapter >> Page > |

In addition, the foreign exchange market is one of the most traded and liquid instruments in the financial world, and serves as a barometer of broader financial market conditions and risk appetite.

Currency risk is the potential consequence from an adverse movement in foreign exchange rates (Coyle, 2000). Organizations are exposed to currency risk when involved, directly or indirectly, in international trade and finance. Currency risk arises because exchange rates are volatile in the short and the long-term and the future movements of exchange rates cannot be predicted. Companies will as a result suffer losses due to adverse exchange rate movements when exposed to foreign currencies (Coyle, 2000).

Hedging is the term used to describe the actions that reduce or eliminate an exposure to risk (Coyle, 2000). Common ways of hedging currency risk involve:

A financial derivative is a financial instrument where the price is derived from the value of an underlying asset often used to manage risk exposure. There are three classes of derivatives.

Futures: A futures contract is a “commitment to exchange a specified amount of one asset for a specified amount of another asset at a specified time in the future” (Butler, 2003).

Options: An options contract “gives the option holder the right to buy or sell an underlying asset at a specified price and on a specified date” (Butler, 2003).

Swaps: A swap is an “agreement to exchange two liabilities (or assets) and, after a prearranged length of time, to re-exchange the liabilities (or assets)” (Butler, 2003).

Financial derivatives are a very complex system of agreements. It is wise to consult a banking professional for advice on how to implement.

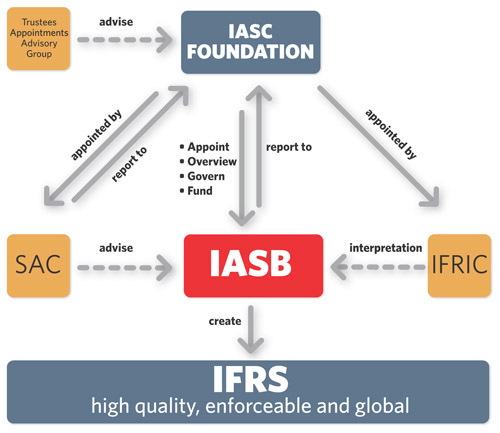

The International Accounting Standards Committee (IASC) Foundation, formed in March 2001, is the parent body of the International Accounting Standards Board (IASB). The IASB, formed on April 1, 2001, has assumed accounting standard-setting responsibilities from its predecessor body, the IASC (International Accounting Standard Boards: About Us, n.d.).

The objectives of the IASB are:

Even though the IASB standards are not enforced internationally at this time, the standards are quickly being processed. Therefore, a company looking to go international should abide by IASB standards.

With the Aga Khan Rural Support Programme (AKRSP) micro-loan, Ms. Shahira has begun to venture into the global financial marketplace. While the funding from the loan was sufficient for Ms. Shahira’s small business at the time, upon expansion, she will require additional sources of capital. Understanding the home country’s financial system, and the alternative funding sources available abroad, is a key element of furthering her sewing company.

Notification Switch

Would you like to follow the 'Business fundamentals' conversation and receive update notifications?