| << Chapter < Page | Chapter >> Page > |

Rapid decline rates in shale wells are not only reasons for caution in predicting U.S. oil independence over the next few years. Fracking as practiced in the U.S. is expensive ($5 million per well and up). High prices, reaching a peak of over $120 per barrel (2014) have attracted high investment levels in shale-bearing regions. Fracking operations turn out to be quite sensitive to oil prices. From June 2014 to mid-November 2014, oil prices per bbl. (Brent prices)

The reader should be aware that there are two distinct benchmark prices for petroleum: the Brent price and the price for West Texas crude. The Brent price (named after the Belgian port) is typically used in reference to prices in Europe, Africa, South Asia and parts of East Asia. The West Texas crude price is ordinarily quoted for U.S.-source crude. The Brent price is typically 10% to 15% above that of West Texas crude. In July 2014, the Brent price was $115 per barrel, versus $106 for West Texas crude. Both prices dropped sharply by December 2014: the Brent price was $60/ bbl., while that for West Texas crude was $55. This figure is based on a sample of operating costs in eight large independent firms. Some firms, however, have costs exceeding $40/bbl. The sample is cited in the Economist, December 6, 2014. p.81.

In any case, it is apparent that the combination of the innovation of directional drilling and octopus drilling with changes in fracturing practices that has been responsible for the huge recent increases in gas and oil output reserves in the U.S. and elsewhere, especially from shale formations.

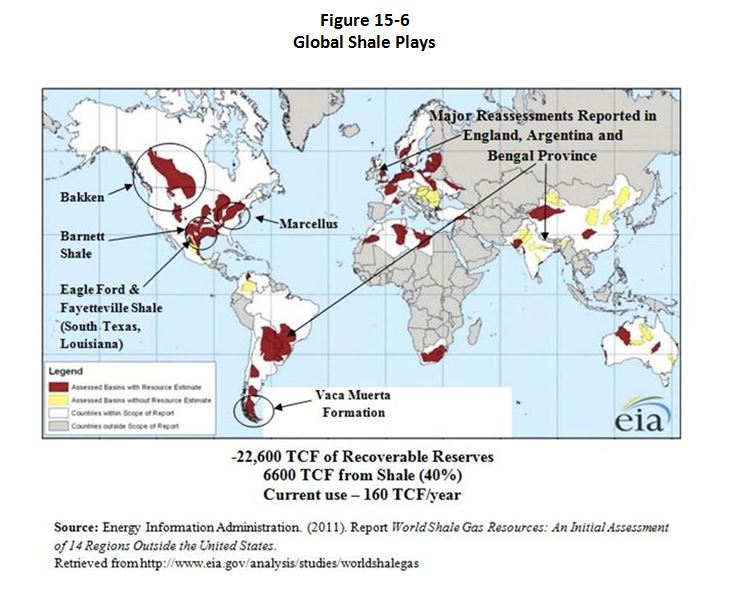

By 2015 the shale boom in the quest for hydrocarbons has hardly begun in the rest of the world, especially in emerging nations (see Figure 15-6).

The reader may wonder why the discussion on shale, directional drilling/fracking has been presented in such detail. There is in fact a very good reason. These developments have already begun to materially change the world energy picture, not only as it pertains to developed nations, but to emerging nations as well. Notable environmental risks may also be involved. But that is not all. The reverberations from shale will resound down through the next 30 years, and will affect the lives of hundreds of millions worldwide.

Notification Switch

Would you like to follow the 'Economic development for the 21st century' conversation and receive update notifications?