| << Chapter < Page | Chapter >> Page > |

The Fed Chair is first among equals on the Board of Governors. While he or she has only one vote, the Chair controls the agenda, and is the public voice of the Fed, so he or she has more power and influence than one might expect.

Visit this website to see who the current members of the Federal Reserve Board of Governors are. You can follow the links provided for each board member to learn more about their backgrounds, experiences, and when their terms on the board will end.

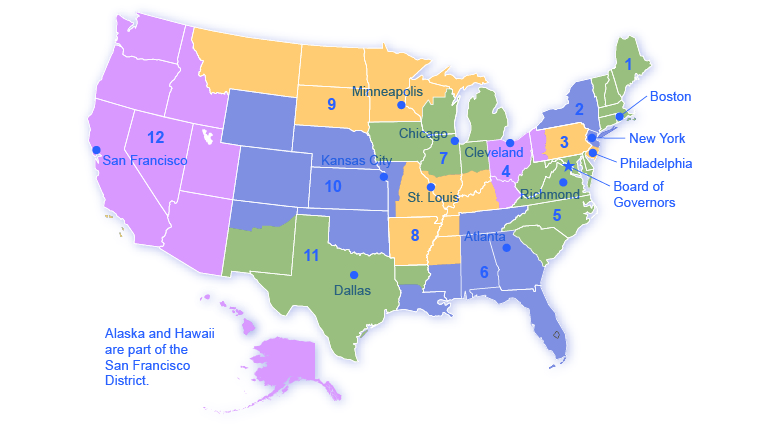

The Federal Reserve is more than the Board of Governors. The Fed also includes 12 regional Federal Reserve banks, each of which is responsible for supporting the commercial banks and economy generally in its district. The Federal Reserve districts and the cities where their regional headquarters are located are shown in [link] . The commercial banks in each district elect a Board of Directors for each regional Federal Reserve bank, and that board chooses a president for each regional Federal Reserve district. Thus, the Federal Reserve System includes both federally and private-sector appointed leaders.

The Federal Reserve, like most central banks, is designed to perform three important functions:

The first two functions are sufficiently important that we will discuss them in their own modules; the third function we will discuss here.

The Federal Reserve provides many of the same services to banks as banks provide to their customers. For example, all commercial banks have an account at the Fed where they deposit reserves. Similarly, banks can obtain loans from the Fed through the “discount window” facility, which will be discussed in more detail later. The Fed is also responsible for check processing. When you write a check, for example, to buy groceries, the grocery store deposits the check in its bank account. Then, the physical check (or an image of that actual check) is returned to your bank, after which funds are transferred from your bank account to the account of the grocery store. The Fed is responsible for each of these actions.

On a more mundane level, the Federal Reserve ensures that enough currency and coins are circulating through the financial system to meet public demands. For example, each year the Fed increases the amount of currency available in banks around the Christmas shopping season and reduces it again in January.

Finally, the Fed is responsible for assuring that banks are in compliance with a wide variety of consumer protection laws. For example, banks are forbidden from discriminating on the basis of age, race, sex, or marital status. Banks are also required to disclose publicly information about the loans they make for buying houses and how those loans are distributed geographically, as well as by sex and race of the loan applicants.

The most prominent task of a central bank is to conduct monetary policy, which involves changes to interest rates and credit conditions, affecting the amount of borrowing and spending in an economy. Some prominent central banks around the world include the U.S. Federal Reserve, the European Central Bank, the Bank of Japan, and the Bank of England.

Matthews, Dylan. “Nine amazing facts about Janet Yellen, our next Fed chair.” Wonkblog. The Washington Post . Posted October 09, 2013. http://www.washingtonpost.com/blogs/wonkblog/wp/2013/10/09/nine-amazing-facts-about-janet-yellen-our-next-fed-chair/.

Appelbaum, Binyamin. “Divining the Regulatory Goals of Fed Rivals.” The New York Times . Posted August 14, 2013. http://www.nytimes.com/2013/08/14/business/economy/careers-of-2-fed-contenders-reveal-little-on-regulatory-approach.html?pagewanted=3.

Notification Switch

Would you like to follow the 'Macroeconomics' conversation and receive update notifications?