| << Chapter < Page | Chapter >> Page > |

Now, First National must hold only 10% as required reserves ($900,000) but can lend out the other 90% ($8.1 million) in a loan to Jack’s Chevy Dealership as shown in [link] .

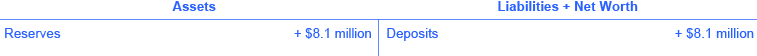

If Jack’s deposits the loan in its checking account at Second National, the money supply just increased by an additional $8.1 million, as [link] shows.

How is this money creation possible? It is possible because there are multiple banks in the financial system, they are required to hold only a fraction of their deposits, and loans end up deposited in other banks, which increases deposits and, in essence, the money supply.

Watch this video to learn more about how banks create money.

In a system with multiple banks, the initial excess reserve amount that Singleton Bank decided to lend to Hank’s Auto Supply was deposited into Frist National Bank, which is free to loan out $8.1 million. If all banks loan out their excess reserves, the money supply will expand. In a multi-bank system, the amount of money that the system can create is found by using the money multiplier. The money multiplier tells us by how many times a loan will be “multiplied” as it is spent in the economy and then re-deposited in other banks.

Fortunately, a formula exists for calculating the total of these many rounds of lending in a banking system. The money multiplier formula is:

The money multiplier is then multiplied by the change in excess reserves to determine the total amount of M1 money supply created in the banking system. See the Work it Out feature to walk through the multiplier calculation.

Using the money multiplier for the example in this text:

Step 1. In the case of Singleton Bank, for whom the reserve requirement is 10% (or 0.10), the money multiplier is 1 divided by .10, which is equal to 10.

Step 2. We have identified that the excess reserves are $9 million, so, using the formula we can determine the total change in the M1 money supply:

Step 3. Thus, we can say that, in this example, the total quantity of money generated in this economy after all rounds of lending are completed will be $90 million.

The money multiplier will depend on the proportion of reserves that banks are required to hold by the Federal Reserve Bank. Additionally, a bank can also choose to hold extra reserves. Banks may decide to vary how much they hold in reserves for two reasons: macroeconomic conditions and government rules. When an economy is in recession, banks are likely to hold a higher proportion of reserves because they fear that loans are less likely to be repaid when the economy is slow. The Federal Reserve may also raise or lower the required reserves held by banks as a policy move to affect the quantity of money in an economy, as Monetary Policy and Bank Regulation will discuss.

Notification Switch

Would you like to follow the 'Macroeconomics' conversation and receive update notifications?