| << Chapter < Page | Chapter >> Page > |

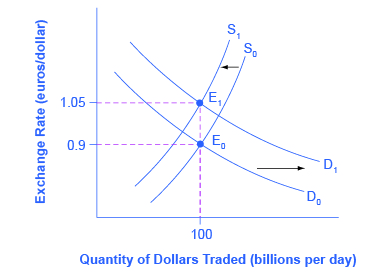

Exchange rates can also help to explain why budget deficits are linked to trade deficits. [link] shows a situation using the exchange rate for the U.S. dollar, measured in euros. At the original equilibrium (E 0 ), where the demand for U.S. dollars (D 0 ) intersects with the supply of U.S. dollars (S 0 ) on the foreign exchange market, the exchange rate is 0.9 euros per U.S. dollar and the equilibrium quantity traded in the market is $100 billion per day (which was roughly the quantity of dollar–euro trading in exchange rate markets in the mid-2000s). Then the U.S. budget deficit rises and foreign financial investment provides the source of funds for that budget deficit.

International financial investors, as a group, will demand more U.S. dollars on foreign exchange markets to purchase the U.S. government bonds, and they will supply fewer of the U.S. dollars that they already hold in these markets. Demand for U.S. dollars on the foreign exchange market shifts from D 0 to D 1 and the supply of U.S. dollars falls from S 0 to S 1 . At the new equilibrium (E 1 ), the exchange rate has appreciated to 1.05 euros per dollar while, in this example, the quantity of dollars traded remains the same.

A stronger exchange rate, of course, makes it more difficult for exporters to sell their goods abroad while making imports cheaper, so a trade deficit (or a reduced trade surplus) results. Thus, a budget deficit can easily result in an inflow of foreign financial capital, a stronger exchange rate, and a trade deficit.

You can also imagine this appreciation of the exchange rate as being driven by interest rates. As explained earlier in Budget Deficits and Interest Rates in Fiscal Policy, Investment, and Economic Growth , a budget deficit increases demand in markets for domestic financial capital, raising the domestic interest rate. A higher interest rate will attract an inflow of foreign financial capital, and appreciate the exchange rate in response to the increase in demand for U.S. dollars by foreign investors and a decrease in supply of U. S. dollars. Because of higher interest rates in the United States, Americans find U.S. bonds more attractive than foreign bonds. When Americans are buying fewer foreign bonds, they are supplying fewer U.S. dollars. The depreciation of the U.S. dollar leads to a larger trade deficit (or reduced surplus). The connections between inflows of foreign investment capital, interest rates, and exchange rates are all just different ways of drawing the same economic connections: a larger budget deficit can result in a larger trade deficit, although the connection should not be expected to be one-to-one.

Notification Switch

Would you like to follow the 'Principles of economics' conversation and receive update notifications?