| << Chapter < Page | Chapter >> Page > |

The literature on the role of institutions had become very rich and very sizeable by 2014. A short chapter in a book such as this one cannot begin to do justice to the insights to be gained from this literature. That said we now proceed to examine some of the most salient points of this growing body of work.

We begin by noting that for decades, economists and aid agencies urged poor countries to “get their policies right.” First and foremost what they really meant was to get their “ prices ” right. They were mainly referring to “macro prices, such as:

This was part of the so-called Washington Consensus in the eighties and early nineties, well described elsewhere. See Dwight H. Perkins, Stephen Radelet&David L. Lindauer (2006), Economics of Development , New York, NY: W.W. Norton, Chapter 5: 179-181.

However getting policies right is only a necessary condition for initiating sustaining economic growth; it is far from a sufficient condition.

This was clearly evident from experiences in nineties in Poland and Russia. Advised by Professor Jeff Sachs, both countries attempted reforms aimed at “getting prices right” but the efforts were generally unsuccessful.

Why ? The remedies offered ignored institutions and institutional weaknesses, especially problems of governance.

There are many definitions of the “Rule of Law”. Basically the rule refers to how well important institutions function, institutions such as property rights, contract enforcement, stability in governance, even-handed governance (in the public and private sector) accountability in governance, the quality of bureaucracies and much else.

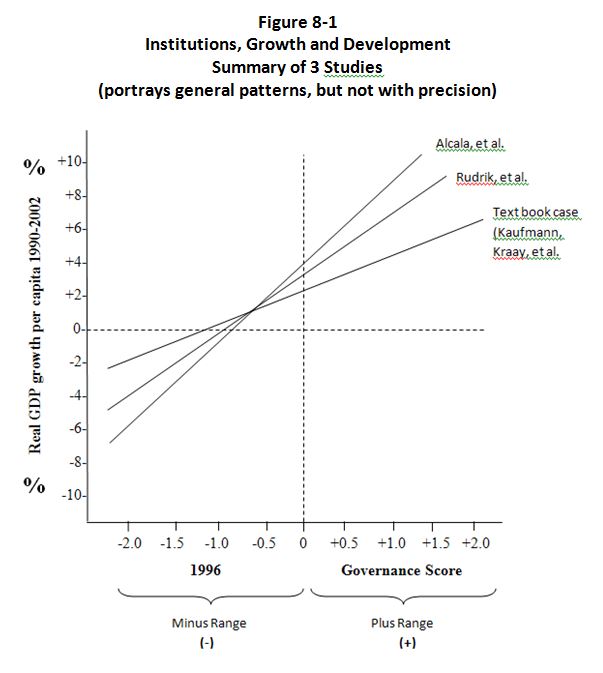

It is helpful to examine three studies of more than 75 nations by Kaufmann and Kraay, D. Kaufmann, A. Kraay&M. Mastruzzi, “Governance Matters III: Indicators for 1996-2002”, Washington, DC: The World Bank, Policy Research Working Paper #3106, 2003. Rodrik and others Dani Rodrik, Arvind Subramanian&Francesco Trebbi, “Institutions Rule: The Primacy of Institutions over Geography and Integration in Economic Development, Cambrdge, MA: NBER Working Paper #9305, November 2002. and Alcalà and Ciccone. These studies relate GDP per person to estimates of high or low degrees of Rule of Law. All these studies find a clear association between six dimensions of governance (including the Rule of Law) and economic growth (See Figure 8-1). Together, the six dimensions are called the “governance score”. The “governance score” depicted in Figure 8-1 summarizes these six dimensions”. (1) Press Freedom (Voice and Accountability), (2) Political Stability, (3) Government Effectiveness, (4) Quality of the Regulatory Climate, (5) the Rule of Law, and (6) Limits on Corruption in both public and private sector.

Each of the six dimensions is important. But perhaps the most significant is that of property rights. For a similar view, see Daron Acemoglu, Simon Johnson&James Robinson, (2001, December), “The Colonial Origins of Comparative Development: An Empirical Investigation”, The American Economic Review , 91(5): 1369-1401.

Notification Switch

Would you like to follow the 'Economic development for the 21st century' conversation and receive update notifications?